On July 4, 2025, President Trump signed the One Big Beautiful Bill Act, a sweeping tax package that included something historic for our industry: the No Tax on Tips Act. For the first time, tipped workers across America can keep more of what they earn without Uncle Sam taking a slice.

💵 What the Law Says

- Eligible workers can deduct up to $25,000 in voluntary tips per year from federal taxable income.

- Applies to tax years 2025 through 2028.

- Begins to phase out for single filers earning over $150,000 and joint filers over $300,000.

- Covers voluntary tips only — mandatory service charges or automatic gratuities don’t qualify.

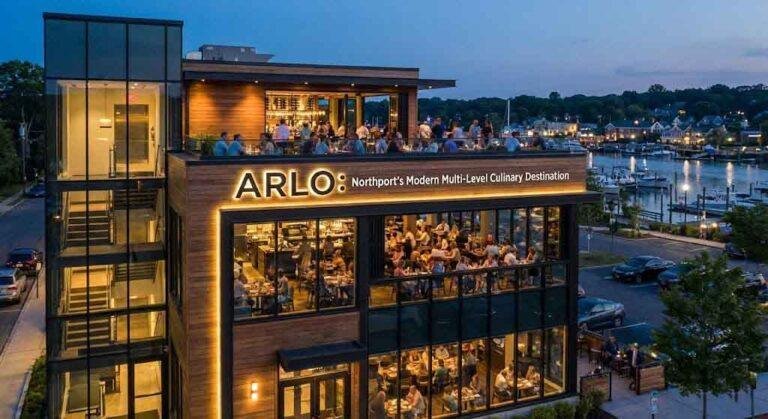

🗽 What It Means for Long Island

Here in New York, things get complicated. While the federal law is clear, states can choose whether to follow it. New York lawmakers have already signaled they may “decouple” from the federal code, meaning tipped workers here could still owe state income tax on tips even though they’re exempt federally.

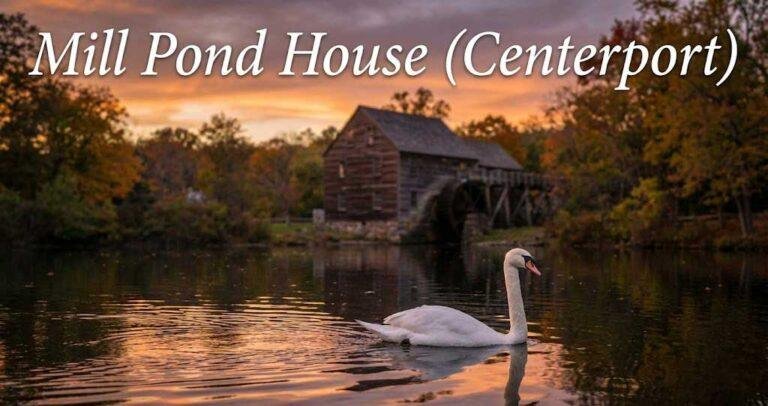

For our servers, bartenders, and kitchen staff, that means:

- More take‑home pay at the federal level.

- State taxes may still apply, depending on Albany’s final decision.

- Payroll systems and tax prep software will need updates to handle the split.

🍽 Why It Matters

At Heritage Diner, tips aren’t just extra — they’re a lifeline for many of our team members. This law recognizes the value of service work and gives millions of Americans a chance to keep more of their hard‑earned money. For diners, it’s a reminder that every dollar tipped goes further now, helping staff cover rent, groceries, and family needs.

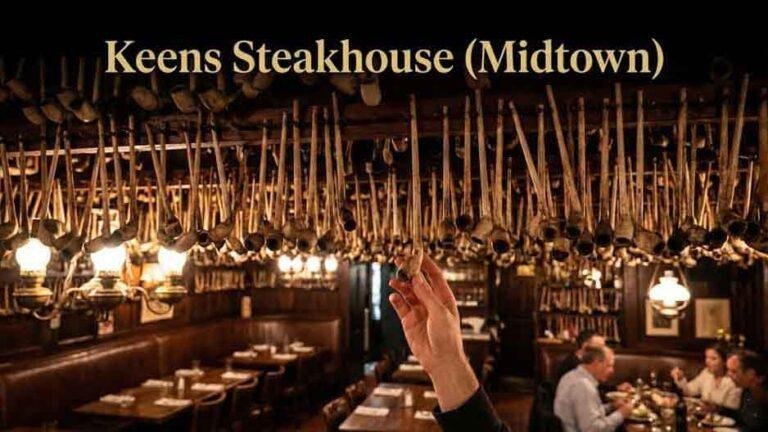

🏛 The Bigger Picture

The “No Tax on Tips” provision is part of a broader push to ease the burden on working Americans. Alongside deductions for overtime pay and seniors, it highlights how central the service industry is to our economy. According to Yale’s Budget Lab, about 4 million Americans — 1 in 40 workers — rely on tips as a major part of their income.

✅ Takeaway

For Long Island’s service workers, this law is both a win and a challenge. It puts more money back in pockets, but state rules may limit the benefit. As always, we’ll keep our staff and community updated as the details unfold.