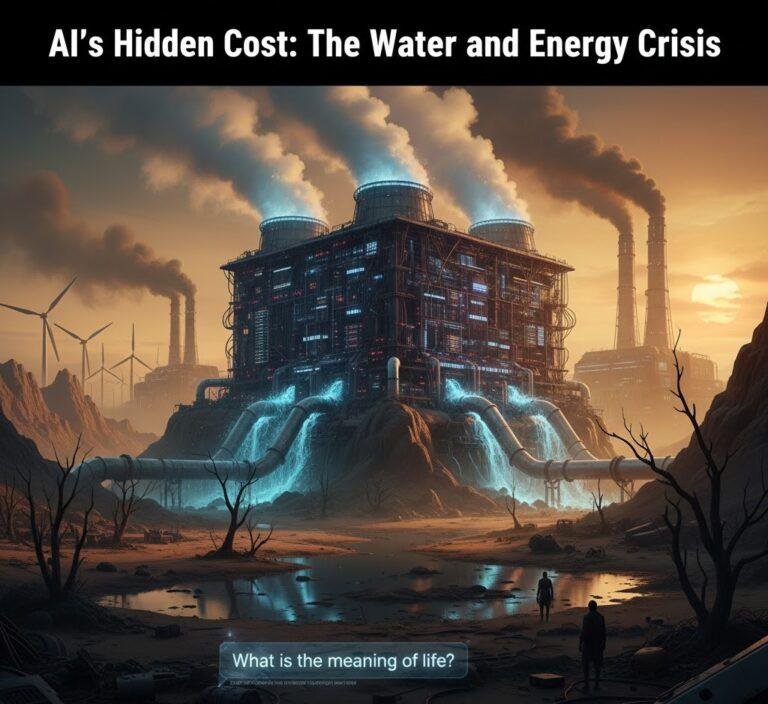

- Utility stocks climb as tech firms ink multi-billion dollar “behind-the-meter” power deals

- Microsoft and Google warn that carbon-neutral goals face “significant headwinds” from 24/7 AI workloads

- International Energy Agency (IEA) predicts data center electricity consumption will double by 2027

The “trillion-dollar” AI race has hit a physical wall, and it isn’t just silicon—it’s the power grid. As Microsoft, Amazon, and Google race to deploy next-generation AI clusters, the sheer volume of electricity required is forcing tech giants to become energy developers in their own right.

The Power Bottleneck

While the industry has focused on GPU shortages, the real bottleneck is now the time it takes to connect a data center to the grid. In Northern Virginia—the world’s largest data center hub—wait times for new high-capacity connections have stretched to several years.

This scarcity is driving a shift in strategy. Tech companies are no longer just buyers; they are investing directly in nuclear small modular reactors (SMRs) and geothermal startups to bypass traditional utility delays.

A “Continuous” Appetite

Late yesterday, energy analysts noted that AI chips like Nvidia’s Blackwell architecture require significantly more cooling and power per rack than previous generations. “We aren’t just talking about more power; we’re talking about constant, high-density load that the current grid wasn’t designed for,” noted one industry report.

According to recent data from the Commercial Times, the global capacity for liquid-cooled data centers—essential for high-performance AI—is expected to grow by over 85% year-on-year through 2026.

The Market Impact

Retail investors are pivoting toward “AI adjacent” energy plays. The Motley Fool recently highlighted Constellation Energy and NextEra Energy as “essential infrastructure” for the AI era. These companies are increasingly seen as the “landlords” of the AI revolution, providing the baseline power that keeps the models running.

However, the downside remains clear. If the return on investment for AI software fails to materialize, the massive capital expenditure on energy-heavy infrastructure could lead to a market correction. Furthermore, local governments are beginning to push back, citing concerns that data centers are driving up electricity costs for residential consumers.

What to Watch

Investors should keep a close eye on upcoming quarterly reports from major utilities and any new “power-purchase agreements” (PPAs) announced by big tech. The race is no longer just about who has the best model, but who can keep the lights on