The first quarter of 2026 is revealing a Long Island real estate market that’s neither the pandemic frenzy of 2021 nor the anticipated crash some predicted for 2024. Instead, Q1 2026 represents what industry professionals are calling “The Great Normalization”—a return to fundamental supply-demand economics with one critical twist: inventory remains stubbornly low while mortgage rates have stabilized higher than most buyers hoped.

If you’re buying, selling, or simply tracking your home’s value this quarter, understanding the nuanced shifts happening across Nassau and Suffolk Counties isn’t optional—it’s essential. The market isn’t moving in one clear direction. It’s fragmenting by price point, property type, and geography in ways that create distinct winners and losers.

Here’s everything happening in the Long Island real estate market as we close Q1 2026, backed by actual data, not wishful thinking.

The Big Picture: Where We Stand in Q1 2026

The Numbers That Matter

Nassau County (February 2026):

- Median sold price: $831,000 (up 0.9% month-over-month, ~7% year-over-year)

- Median listing price: $849,000 (up 10.4% YoY)

- Sold-to-list ratio: 100.4% (buyers paying over asking on average)

- Median days on market: 34 days

- Months of inventory: 2.08 months

- Market classification: Strong seller’s market

Suffolk County (February 2026):

- Median sold price: $725,000 (up ~6-7% YoY)

- Days on market: 32-40 days (varies by location)

- Inventory: Slightly higher than Nassau but still under 3 months

- Market classification: Seller’s market with pockets of balance

What these numbers mean:

- Balanced market = 6 months inventory. We’re at 2.08 months in Nassau.

- At current sales pace, ALL available Nassau County inventory would sell in 75 days if no new listings appeared.

- Buyers still outnumber sellers significantly.

- Well-priced homes receive multiple offers.

- Overpriced homes sit 60-90+ days before price cuts.

The Interest Rate Reality

Current mortgage rates (February 2026): 6.15% (30-year fixed)

Year-end projections: 5.9-6.2% (modest decline expected)

This is the number driving everything else. At 6.15%, the monthly payment on a $700,000 Long Island home (roughly the entry point for move-up buyers) is:

- Principal & Interest: $4,273

- Property Taxes: $1,200-$1,500

- Insurance: $200-$300

- Total: $5,673-$6,073/month

Compare to the same home at 3.5% rates (2020-2021):

- Total monthly: $3,973-$4,273

The delta: $1,700-$1,800 more per month = $20,400-$21,600 per year

This isn’t minor. This is “can we afford Long Island at all?” territory for many households.

The Mortgage Lock-In Effect

Here’s why inventory stays tight: Homeowners with 3-3.5% mortgages from 2020-2021 face a brutal calculation.

Example:

- Current home: $500,000 mortgage at 3.25% = $2,176/month

- New home: $650,000 mortgage at 6.15% = $3,961/month

- Penalty for moving: $1,785/month = $21,420/year

Unless life circumstances force a move (job relocation, divorce, family size change), why would anyone voluntarily pay $21,000 more annually for housing?

Result: Inventory that would normally hit the market stays locked up. Spring 2026 inventory increases are happening, but they’re modest—not the flood some predicted.

Breaking Down Q1 2026 by Market Segment

Entry-Level Market ($400K-$600K): Fierce Competition

What’s happening:

- Multiple offers standard

- Homes selling in days, not weeks

- Buyers waiving contingencies (information-only inspections common)

- First-time buyers using down payment assistance ($25K-$60K programs)

Where this price range exists:

- Suffolk: Brentwood, Central Islip, Bay Shore, Copiague, Lindenhurst

- Nassau: Freeport, Hempstead, Roosevelt (very limited)

Why it’s competitive:

- Lowest barrier to entry

- First-time buyers must enter market somewhere

- Down payment assistance programs create new qualified buyers

- Investor activity (15-20% of buyers in this range)

Q1 trend: Prices in this segment up 8-10% YoY—highest appreciation rate on Long Island.

Mid-Market ($600K-$900K): The Squeeze Zone

What’s happening:

- Longer days on market (45-60 days common)

- Price cuts frequent (15-20% of listings)

- Turnkey properties sell fast, dated homes struggle

- Buyers highly selective

Why it’s struggling:

- Move-up buyers feel locked in (see mortgage penalty above)

- This range requires $180K-$270K household income at 6.15% rates

- Top 15-20% of Long Island households—smaller buyer pool

- Can wait for perfect home vs. settling

Where this exists:

- Suffolk: Smithtown, Commack, East Northport, Patchogue

- Nassau: Levittown, Hicksville, Massapequa, Merrick

Q1 trend: Flat to 2-3% appreciation. Homes priced right sell in 30-45 days. Overpriced homes sit 90+ days.

Upper-Middle Market ($900K-$1.5M): Performance Varies Wildly

What’s happening:

- School districts matter more than ever

- Condition is king (dated homes dead in water)

- Location premiums widening

- Cash buyers more common

Well-performing areas:

- Nassau: Great Neck, Manhasset, Garden City, Roslyn

- Suffolk: Smithtown (certain sections), Port Jefferson, Setauket

Struggling areas:

- Anywhere requiring significant updates

- Towns with high property taxes relative to quality

- Areas without top school districts

Q1 trend: Bifurcated market. A+ school districts up 5-7%. B school districts flat or down slightly.

Luxury Market ($1.5M+): Surprisingly Resilient

What’s happening:

- Rates matter less (higher cash buyer percentage)

- Quality of life purchases (space, privacy, amenities)

- International and out-of-state buyers active

- Waterfront premiums expanding

Hot segments:

- Gold Coast (North Shore estates)

- Hamptons (seasonal + primary residence buyers)

- Waterfront anywhere

- New construction luxury

Q1 trend: Up 4-6% in prime locations. Days on market longer than pandemic era but sales still happening.

Geographic Trends: Nassau vs. Suffolk

Nassau County: Premium Pricing, Limited Options

Advantages:

- Closer to NYC (commute matters)

- Perception of better schools (true in many cases)

- More infrastructure, services

- Stronger property value history

Challenges:

- Higher prices across all segments

- Property taxes among nation’s highest

- Very limited inventory under $600K

- Aging housing stock (most homes built pre-1980)

Q1 hotspots:

- Great Neck: Median $925,813 (up 144% YoY—data point driven by luxury sales)

- Garden City: $900K-$1.5M range, 40-minute LIRR to Penn Station

- Rockville Centre: Strong downtown, nightlife, family appeal

- Syosset/Jericho: Top schools driving premium

Q1 struggles:

- Hempstead: Affordability exists but buyer hesitancy

- Parts of Elmont/Franklin Square: Stigma vs. reality disconnect

Suffolk County: More Diversity, More Opportunity

Advantages:

- More affordable entry points

- More new construction

- Beach/water access in many areas

- Room to grow (less built-out than Nassau)

Challenges:

- Longer commutes to NYC

- School district quality varies significantly

- Some areas still recovering from 2008 downturn

- Less infrastructure in eastern areas

Q1 hotspots:

- Smithtown: Median $940K (up 36.2% YoY per Redfin June 2025 data, likely stabilizing Q1 2026)

- Port Jefferson: Walkable downtown, ferry access, strong community

- Patchogue: Downtown revitalization success story

- Commack: Family-friendly, strong schools, central location

Q1 opportunities:

- Medford: Affordable, growing, near LIE

- West Babylon: Classic suburban, under $500K options

- Bay Shore: Revitalized downtown, ferry to Fire Island

What’s Driving the Q1 2026 Market

Factor 1: Pending Rate Cuts (Maybe)

Federal Reserve signals suggest possible rate cuts in 2026, but:

- Inflation remains sticky

- Job market still strong

- Rate cuts likely modest (0.25-0.50% total for year)

Impact: If rates drop to 5.75% by year-end, monthly payment on $700K loan drops by ~$150/month. Helpful but not transformative.

Factor 2: New Listing Patterns

Q1 2026 shows:

- Listings up 10-15% vs. Q1 2025

- BUT still down 25-30% vs. pre-pandemic Q1 averages

- Sellers pricing more realistically

- Fewer “test the market” overpriced listings

What this means: Slight improvement in inventory won’t shift market to buyers’ favor. Need sustained months of increased listings.

Factor 3: Buyer Behavior Shifts

Buyers in Q1 2026 are:

- More cautious (learned from 2021-2022 FOMO)

- Focused on monthly payment, not just price

- Prioritizing turnkey condition (won’t overpay for fixer-uppers)

- Demanding home office space

- Concerned about climate/flood risk

Result: Selective buying. Will act fast on perfect home, patient otherwise.

Factor 4: Economic Uncertainty

- Federal government shutdown (Oct 2025-Nov 2025) longest in history at 43 days

- Economic impacts still being assessed

- Job market strong but cooling

- Consumer confidence mixed

Impact on RE: Buyers want job security before buying. Sellers want to sell while prices are still up. Creates tension.

Neighborhood Spotlight: What’s Hot in Q1 2026

Smithtown: The Suburban Dream That Keeps Appreciating

Why it’s sought-after:

- Top-rated schools (Smithtown Central School District A/A- rating)

- Safe, family-friendly

- Central Suffolk location (access to both shores)

- 50-minute LIRR commute to Penn Station

- Strong community feel

Q1 data:

- Median price: $940K (per Redfin mid-2025, likely $900K-$950K Q1 2026)

- Very competitive (homes receive 4 offers on average)

- Selling in ~22 days

- Mostly single-family detached (88% of housing stock)

Buyer profile: Families prioritizing schools, professionals with stable incomes, move-up buyers from Nassau.

Great Neck: North Shore Prestige Meets NYC Convenience

Why it works:

- 30-minute LIRR to Penn Station/Grand Central

- Great Neck Public Schools ranked #20 nationally for 2026

- Walkable downtown (Middle Neck Road)

- Diverse, international community

- Cultural amenities (parks, libraries, community centers)

Q1 data:

- Median price: $925,813 (note: heavily influenced by luxury sales)

- Strong mix of housing types

- Appeal to NYC professionals, international buyers

- Multiple price tiers ($600K condos to $3M+ estates)

Buyer profile: High-income professionals, multigenerational families, international buyers seeking top schools.

Port Jefferson: North Shore Charm Without North Shore Prices

Why it’s rising:

- Actual walkable village (rare on Long Island)

- Ferry to Connecticut (unique)

- Vibrant downtown (restaurants, bars, Theatre Three)

- Waterfront lifestyle

- Strong community identity

Q1 data:

- Median $650K-$750K range

- More affordable than comparable North Shore towns

- Mix of housing types

- LIRR station (Port Jeff Branch)

Buyer profile: Young professionals, empty nesters downsizing, people seeking lifestyle over school districts.

Patchogue: The Revitalization Success Story

What changed:

- Downtown completely transformed (2000s-2020s)

- Arts district, nightlife, waterfront dining

- New apartments/mixed-use development

- Ferry to Fire Island

- Real “Main Street USA” vibe

Q1 data:

- Median $550K-$650K

- Attracts younger buyers (30s-40s)

- Mix of renovated historic homes and new construction

- Growing rental market

Buyer profile: First-time buyers, artists/creatives, young families wanting walkability.

The Segments Struggling in Q1 2026

Fixer-Uppers: Nobody Wants Projects

The problem:

- Renovation costs skyrocketed (labor, materials both up)

- Buyers want turnkey (learned lesson from HGTV fantasies)

- Cost to renovate often exceeds value added

- Financing challenges (renovation loans difficult)

Example:

- House needs $80K in work

- Seller prices at $620K (thinking below-market attracts)

- Turnkey comparable sells for $690K

- Buyers offer $540K or walk

- Nobody wins

Q1 reality: Dated homes selling 15-25% below comparable updated homes.

High-Tax Towns Without Commensurate Quality

Long Island property taxes are brutal everywhere, but some towns offer better value:

Good value (quality justifies taxes):

- Great Neck, Jericho, Garden City (top schools)

- Rockville Centre (walkable downtown + schools)

Questionable value:

- Towns with $15K+ annual taxes and mediocre schools

- Areas where taxes increased faster than services/quality

Q1 trend: Buyers doing tax-to-quality analysis. High taxes alone don’t kill sales, but high taxes + mediocre schools does.

Far Eastern Suffolk Without Water Access

The challenge:

- 90+ minute commutes

- Fewer jobs/amenities locally

- Not quite Hamptons (no prestige premium)

- Not quite affordable enough to justify distance

Struggling areas:

- Mastic, Mastic Beach, parts of Shirley

- Some areas of Riverhead (away from downtown)

Exception: Anywhere with water access, even far east, holds value better.

What Q2 2026 Will Likely Bring

Spring Inventory Surge (Modest)

Expect:

- 15-20% more listings April-June vs. Q1

- Still below historical norms

- Sellers pricing realistically from day one

- Less “testing the market” behavior

Impact: Buyers get more choices but not enough to shift power balance significantly.

Rate Movement (Probably Minimal)

Most likely scenario:

- Rates stay 6.0-6.25% through Q2

- Possible slight decline to 5.9% by June

- No dramatic drops

Don’t expect: Return to 3-4% rates. That era is over for foreseeable future.

Continued Bifurcation

Will accelerate:

- Turnkey homes selling fast

- Dated homes sitting longer

- Top school districts outperforming

- Entry-level staying competitive

- Mid-market ($700K-$1M) requiring patience

Seasonal Patterns Return

2021-2023 saw year-round frenzy. 2026 sees return to:

- Spring/summer peak activity

- Fall activity (motivated buyers)

- Winter slowdown

Advantage: Predictability returns. Sellers can time markets better.

Advice for Q2 2026 and Beyond

For Buyers:

Do:

- Get verified pre-approval (not just pre-qualification)

- Focus on monthly payment, not just price

- Be selective but decisive on the right home

- Negotiate on dated homes (there’s room)

- Factor in total cost (property taxes, insurance, maintenance)

- Consider slightly longer commute for better value

Don’t:

- Wait for rates to crater (not happening soon)

- Expect 2019 prices (not happening ever)

- Waive inspection (especially on Long Island’s aging stock)

- Overextend on price (rates could stay high for years)

For Sellers:

Do:

- Price realistically from day one (overpriced listings die)

- Invest in condition (turnkey sells 15-20% faster)

- Stage professionally (worth every penny)

- Time listing for spring/early summer

- Offer flexibility (closing dates, rent-back)

- Highlight energy efficiency, recent updates

Don’t:

- Price based on 2021-2022 comps (different market)

- List dated home without repairs (won’t get bidding war)

- Reject reasonable offers waiting for “the one” (might not come)

- Ignore feedback (if multiple buyers cite same issues, address them)

The Bottom Line: Q1 2026 Snapshot

Market classification: Seller’s market, moderating

Best opportunities:

- Entry-level buyers with assistance programs

- Luxury buyers (less rate-sensitive)

- Buyers targeting dated homes willing to renovate

- Sellers with turnkey properties in top school districts

Biggest challenges:

- Move-up buyers (locked in by rates)

- Sellers with dated properties

- Anyone expecting 2021 craziness or 2019 prices

What hasn’t changed:

- Long Island remains expensive

- Location and schools drive everything

- Supply remains constrained

- Demand exceeds supply (just less dramatically than 2021)

What has changed:

- Buyers are selective, not desperate

- Sellers must price right from the start

- Condition matters more than ever

- Seasonal patterns returning

Q1 2026 in one sentence: A seller’s market that requires strategy from both buyers and sellers, where the right price, right condition, and right location still result in fast sales, but everything else requires patience, negotiation, and realistic expectations.

The Long Island market isn’t crashing, but it’s not 2021 either. It’s 2026: A market where fundamentals matter again.

Related Articles:

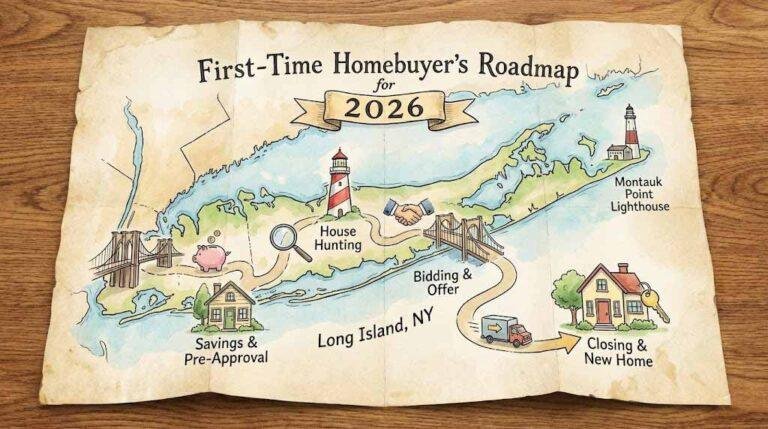

- First-Time Homebuyer’s Roadmap for Long Island in 2026

- How to Win a Bidding War in a Low-Inventory Market

- The Complete Guide to Long Island School Districts

- When Is the Best Time to Sell a Home on Long Island?

- Understanding Property Taxes on Long Island

Sources:

- Redfin Long Island Market Data (February 2026)

- PropertyShark Smithtown Market Trends (Q4 2025)

- NeighborhoodScout Market Analysis

- Behind the Hedges Long Island Agent Forecasts (January 2026)

- EXIT Realty Premier November 2025 Market Report

- HousingWire Inventory Data (January 2026)

- Fannie Mae Rate Projections