The American Dream of homeownership on Long Island isn’t dead—it’s just gotten significantly more expensive and considerably more complicated. With median home prices hovering around $831,000 in Nassau County and $725,000 in Suffolk County as of February 2026, first-time buyers face a market that requires not just savings, but strategy.

This isn’t your parents’ home-buying experience. They bought in the 1990s when Long Island homes cost $150,000-$250,000, mortgage rates were higher but prices were manageable, and down payment assistance programs didn’t exist because they weren’t needed. You’re buying in 2026, when that same house costs $650,000-$900,000, rates are at 6.15%, and without assistance programs, homeownership would be impossible for most Long Islanders under 40.

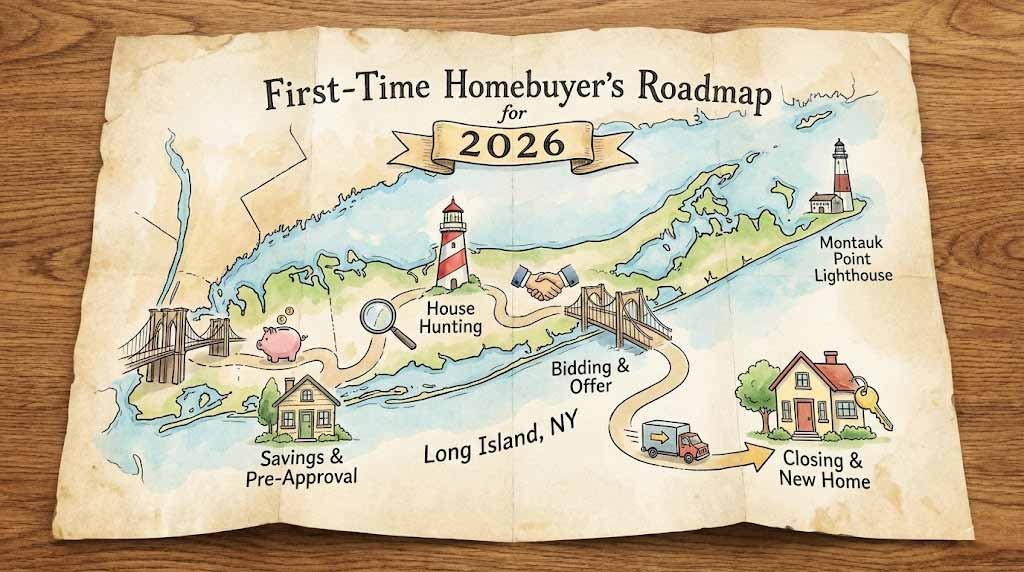

Here’s the complete roadmap—from understanding what you can actually afford, to navigating down payment assistance programs that can provide up to $60,000, to winning in a market where inventory sits at just 2.08 months supply.

Understanding Long Island’s Brutal Affordability Math

Before you fall in love with a listing, you need to understand the numbers that will define whether you’re browsing or actually buying.

The Real Cost Breakdown

A $700,000 home on Long Island (roughly the median for entry-level buyers) breaks down as follows:

Purchase price: $700,000

Minimum down payment (FHA 3.5%): $24,500

Conventional down payment (5%): $35,000

Ideal down payment (20%): $140,000

Monthly payment at 6.15% with 5% down:

- Principal & Interest: $4,046

- Property Taxes (average): $1,200-$1,500

- Homeowners Insurance: $200-$300

- PMI (Private Mortgage Insurance): $250-$350

- Total monthly: $5,696-$6,196

To qualify under the 28% debt-to-income rule, you’d need:

Gross monthly income: $20,342

Annual income: $244,107

See the problem? The median household income on Long Island is approximately $125,000-$130,000. Under traditional lending standards, the median Long Island household cannot afford the median Long Island home.

This is where strategy, down payment assistance, and understanding the actual lending landscape becomes critical.

What Lenders Actually Approve in 2026

While the textbook says 28% front-end debt-to-income ratio, real-world Long Island lenders in 2026 are regularly approving:

- FHA loans: Up to 43% total debt-to-income (including all debts)

- Conventional loans: Up to 45% DTI with compensating factors

- Some portfolio lenders: Up to 50% DTI for strong borrowers

This means a household earning $150,000 can potentially qualify for:

At 43% DTI: $5,375/month housing payment = ~$650,000 purchase price

At 45% DTI: $5,625/month housing payment = ~$700,000 purchase price

Still tight, but more realistic than the textbook numbers suggest.

Down Payment Assistance: Your Secret Weapon

Long Island offers some of the most generous down payment assistance programs in New York State. These aren’t small grants—we’re talking $25,000 to $60,000 in some cases.

Federal Home Loan Bank of New York (FHLBNY) – Homebuyer Dream Program

Available in 2026: $31.67 million allocated across 110 participating lenders

Standard HDP (Homebuyer Dream Program):

- Grant amount: Up to $30,000

- Income limit: At or below 80% Area Median Income (AMI)

- Nassau County 80% AMI (family of 4): ~$112,000

- Suffolk County 80% AMI (family of 4): ~$104,000

- Uses: Down payment, closing costs, homebuyer counseling

- Repayment: None (it’s a grant, not a loan)

HDP Plus:

- Grant amount: Up to $30,000

- Income limit: 80%-120% AMI

- Nassau County 120% AMI (family of 4): ~$168,000

- Suffolk County 120% AMI (family of 4): ~$156,000

HDP Wealth Builder (can be layered with HDP/HDP Plus):

- Additional grant: Up to $30,000

- Total possible: $60,000 when combined

- Focus: Historically underserved communities, wealth gap reduction

- Income limit: Up to 120%-150% AMI depending on location

How to access: Work with a participating lender. The lender handles the application. You don’t apply directly to FHLBNY.

Local Municipality Programs

Nassau County HOME Down Payment Assistance:

- Amount: Up to $50,000

- Minimum buyer contribution: $5,000

- Requirements: First-time buyer, income-eligible (typically under 80% AMI)

- Residency requirement: 10 years or repay the grant

- Application: Through Long Island Housing Partnership (LIHP)

Town of Brookhaven:

- Amount: Up to $50,000

- Minimum buyer contribution: Must meet lender minimums

- Residency requirement: 10 years

- Additional: May qualify for NY State Affordable Housing Corporation funding

Town of Babylon:

- Amount: Up to $25,000

- Minimum buyer contribution: $3,000 (cannot be borrowed)

- Residency requirement: 5 years

- Note: Shorter commitment than other programs

Suffolk County HOME Consortium:

- Structure: Zero-interest deferred loan

- Forgiveness: After 10 years

- Amount: Varies by program availability

State of New York Mortgage Agency (SONYMA)

Down Payment Assistance Loan (DPAL):

- Amount: Varies by program

- Interest: Typically 0% or very low

- Paired with: SONYMA mortgage programs

DPAL Plus ATD (Achieving the Dream):

- Amount: Up to $30,000

- Eligibility: Low-income first-time buyers

- Benefits: Enhanced assistance for income-qualified buyers

FHA Plus & Conventional Plus:

- Combines SONYMA mortgage with down payment assistance

- Available for first-time buyers AND previous homeowners

- Can be used for closing costs as well

Stacking Strategies

Here’s where it gets interesting: some programs can be combined.

Example Scenario:

- HDP Standard: $30,000

- HDP Wealth Builder: $30,000

Total assistance: $60,000

For a $700,000 home:

- Purchase price: $700,000

- Down payment needed (5%): $35,000

- Down payment assistance: $60,000

- Your contribution: $0 (you have $25,000 leftover for closing costs!)

Your monthly payment drops from $5,696 to $4,775 because you’re not paying PMI on a larger down payment.

The Application Process: Step-by-Step Timeline

Month 1-2: Financial Preparation

Week 1-2: Credit Repair

- Pull credit reports from all three bureaus (free at AnnualCreditReport.com)

- Dispute any errors (can take 30-45 days)

- Pay down credit card balances below 30% utilization

- Don’t: Close old cards, open new accounts, make large purchases

Target credit scores:

- FHA: Minimum 580 (3.5% down) or 500 (10% down)

- Conventional: 620 minimum, 680+ for best rates

- SONYMA: 660+ recommended

Week 3-4: Income Documentation Gather:

- Last 2 years tax returns

- Last 2 months pay stubs

- Last 2 months bank statements

- If self-employed: 2 years business tax returns, profit/loss statements

- Other income: Social Security, disability, child support documentation

Week 5-8: Savings

- Calculate down payment + closing costs (3-5% of purchase price)

- Determine if gift funds are allowed (most programs allow from family)

- Document gift funds properly – lenders need gift letters

Month 3: Pre-Approval & Education

Homebuyer Education Course (REQUIRED for most assistance programs):

- Duration: 6-8 hours (can be online or in-person)

- Cost: $75-$125 (often waived for income-qualified buyers)

- Providers: HUD-approved agencies, Long Island Housing Partnership, Community Development Long Island (CDLI)

- Certificate valid: 2 years

Topics covered:

- Budgeting and credit

- Mortgage products

- Home shopping process

- Inspection and appraisal

- Closing process

- Avoiding foreclosure

Lender Pre-Approval:

- Contact 3-5 lenders (including those participating in assistance programs)

- Compare rates, fees, and assistance program access

- Get verified pre-approval, not just pre-qualification

- Verification means underwriting reviewed your documents

Pre-approval vs. Pre-qualification:

- Pre-qualification: “Based on what you told us, you might qualify for $X”

- Pre-approval: “We reviewed your documents and you’re approved for $X”

Month 4-6: House Hunting

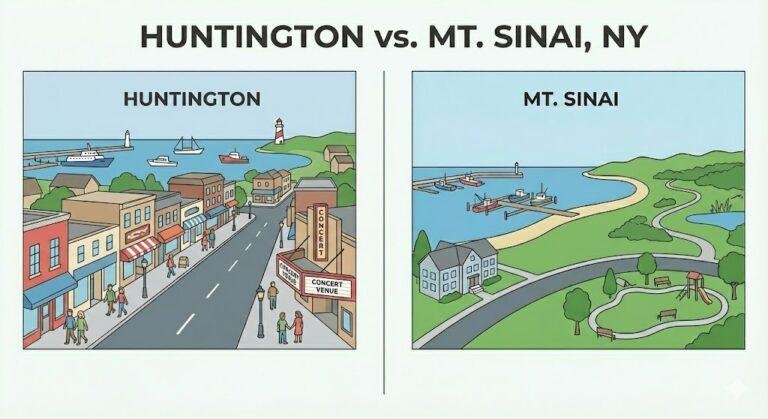

Where First-Time Buyers Can Actually Afford (February 2026):

Under $500,000:

- Brentwood, Central Islip, Bay Shore (Suffolk)

- Roosevelt, Hempstead, Freeport (Nassau – limited)

- Expect: Older homes, smaller lots, may need updates

$500,000-$650,000:

- Copiague, Lindenhurst, West Babylon (Suffolk)

- Hicksville, Plainview (Nassau – entry level)

- Expect: 1950s-1970s construction, starter homes

$650,000-$800,000:

- Patchogue, East Patchogue, Medford (Suffolk)

- Massapequa, Wantagh, Seaford (Nassau)

- Expect: More selection, family-sized homes

Work with an agent who:

- Understands first-time buyer programs

- Can connect you with assistance program lenders

- Knows which towns have lower property taxes (critical for affordability)

- Won’t pressure you above your budget

Month 7: Making the Offer

In a 2.08-month inventory market, you need:

1. Speed:

- See the house within 24 hours of listing

- Make offer within 48 hours if you like it

- Decision fatigue is real—prepare to decide fast

2. Strength:

- Verified pre-approval letter (not just pre-qualification)

- Earnest money deposit ready ($1,000-$2,000 typical)

- Minimal contingencies (but keep inspection!)

- Flexible closing date

3. Strategy:

- Offer close to asking on desirable properties

- Leave room for appraisal gap (more on this below)

- Personal letter to seller (sometimes helps, sometimes doesn’t)

Appraisal Gap Coverage:

Here’s a problem first-time buyers face: In competitive markets, homes sell above asking price. But lenders only lend based on appraised value.

Example:

- List price: $650,000

- Your offer: $670,000 (you beat out 3 other bidders!)

- Appraisal: $655,000

- Gap: $15,000

Your options:

- Renegotiate with seller (they might say no and sell to backup offer)

- Cover the gap yourself ($15,000 cash)

- Walk away (lose earnest money)

Smart strategy: Include in your offer “Buyer will cover up to $10,000 appraisal gap.” This shows you’re serious without overcommitting.

Month 8-9: Inspection, Appraisal, Final Approval

Home Inspection ($400-$600):

- Choose your own inspector (don’t use agent’s recommendation automatically)

- Attend the inspection in person

- For Long Island homes: Pay special attention to:

- Termites (prevalent on Long Island)

- Foundation/moisture (high water table)

- Electrical (many homes have outdated panels)

- Roof (coastal weather causes wear)

- HVAC age (expensive to replace)

Negotiating repairs:

- Sellers in 2026 are less willing to do repairs than in 2020-2021

- Pick your battles—focus on safety issues and big-ticket items

- Consider asking for credit instead of repairs

Appraisal ($500-$700):

- Ordered by lender

- Can’t choose appraiser

- Takes 1-3 weeks in 2026

Final underwriting:

- Lender reviews everything again

- Do NOT:

- Change jobs

- Make large purchases

- Open/close credit cards

- Co-sign loans

- Move money between accounts without documentation

Month 10: Closing

Final walkthrough (day before or day of closing):

- Verify agreed-upon repairs were completed

- Check that appliances/fixtures included in sale are still there

- Turn on all faucets, flush toilets, test appliances

- If major problems found: Closing can be delayed

Closing day:

- Bring:

- Government-issued ID

- Certified check for closing costs (get exact amount 3 days before)

- Proof of homeowners insurance

- All documentation lender requests

- You’ll sign:

- Mortgage note (your promise to repay)

- Deed (transfers ownership)

- Truth in Lending disclosure

- Closing disclosure (itemizes all costs)

- 20+ other documents

Closing costs for first-time buyers (3-5% of purchase price):

- Attorney fees: $1,500-$3,000

- Lender fees: $2,000-$4,000

- Title insurance: $2,000-$5,000

- Recording fees: $500-$1,000

- Prepaid property taxes: Varies

- Prepaid insurance: First year premium

- Transfer taxes: NY State + Nassau/Suffolk county

Total for $700,000 home: $21,000-$35,000

(This is why down payment assistance that covers closing costs is so valuable.)

Common First-Time Buyer Mistakes (And How to Avoid Them)

Mistake 1: Not Getting Pre-Approved Early Enough

The problem: You find your dream home, make an offer, then discover you don’t actually qualify for enough financing.

The fix: Get verified pre-approval BEFORE you tour homes. This means full underwriting review, not just a phone call.

Mistake 2: Ignoring Property Taxes

The reality: Nassau County average effective property tax rate: 2.07%

Suffolk County average: 1.99%

For a $700,000 home:

- Nassau: $14,490/year ($1,207/month)

- Suffolk: $13,930/year ($1,160/month)

Many first-time buyers budget for mortgage but forget property taxes double their monthly payment.

The fix: Use the full PITI calculator (Principal, Interest, Taxes, Insurance) from the start.

Mistake 3: Draining Savings for Down Payment

The problem: You put every dollar toward the down payment, then the furnace dies in month 2.

The fix: Keep 3-6 months of expenses in emergency fund AFTER closing. If you need to choose between 20% down (no PMI) and having an emergency fund, choose the emergency fund.

Mistake 4: Buying at Maximum Approval Amount

The problem: Lender approves you for $750,000. You buy for $750,000. Interest rates increase. Property taxes go up. You can’t afford anything else.

The fix: Buy 10-20% below your maximum approval. Leaves room for life changes.

Mistake 5: Skipping Inspection to Win Bidding War

The problem: You waive inspection to make your offer more attractive. Turns out the foundation is cracked and repairs cost $40,000.

The fix: NEVER waive inspection on Long Island. Old housing stock + coastal environment = too much risk. Instead, offer “information-only inspection” (you inspect but won’t renegotiate based on findings).

Mistake 6: Not Understanding Assistance Program Repayment Terms

The problem: You get $50,000 from Nassau County, accept a job transfer 3 years later, and owe $50,000 back immediately.

The fix: Read the fine print. Most programs require 5-10 years residency. Plan accordingly.

Mistake 7: Choosing House Over Commute

The problem: You save $100,000 buying in eastern Suffolk instead of western Suffolk/Nassau. Your commute increases by 90 minutes each way. You hate your life.

The fix: Factor in commute costs (time + money). A $100,000 cheaper house with 3 hours daily commuting costs more in the long run.

The Reality Check: Can You Actually Afford Long Island?

Here’s the hardest truth in this guide: Even with down payment assistance, even with creative financing, even with a 45% debt-to-income ratio… Long Island homeownership might not be affordable for everyone right now.

You might need to wait if:

- Your income is below $100,000 household and you have no down payment assistance eligibility

- Your credit score is below 620 and won’t improve in the next 6-12 months

- You have significant debt that won’t be paid off for years

- You’re not ready for a 10-year commitment (most assistance programs require this)

- You can’t handle $1,000-$2,000/month property taxes on top of mortgage

Alternatives to consider:

- Rent and save: Build bigger down payment, improve credit, increase income

- Look at condos/co-ops: $400,000-$550,000 range, lower monthly costs

- Consider Queens/Brooklyn: Similar commute to Manhattan, lower entry costs

- Move to cheaper Northeast markets: Still drivable to Long Island for family visits

There’s no shame in recognizing when timing isn’t right. Buying a house you can’t actually afford doesn’t build wealth—it destroys it.

The Bottom Line

First-time homebuying on Long Island in 2026 is absolutely possible, but it requires:

1. Strategic Income: $120,000+ household income (or creative use of assistance programs)

2. Clean Credit: 660+ for best results

3. Assistance Programs: Up to $60,000 available—use them

4. Patience: It might take 6-12 months to get the right house

5. Realistic Expectations: You’re not buying your forever home, you’re buying your first home

6. Professional Help: Use agents/lenders who specialize in first-time buyers

7. Long-term Commitment: Most assistance programs require 5-10 years residency

The median first-time buyer on Long Island in 2026 is:

- 32-38 years old

- Dual income household ($140,000-$180,000 combined)

- Saved $20,000-$40,000 for down payment/closing

- Using $25,000-$50,000 in assistance

- Buying in $550,000-$700,000 range

- Targeting western Suffolk or Nassau County

- Plans to stay 7-10 years minimum

If that’s you, this is doable. If you’re not there yet, focus on getting there. The market isn’t getting cheaper, but assistance programs are expanding and rates may moderate slightly through 2026.

Your first step: Take the HUD homebuyer education course. It’s required for most programs anyway, and it’ll show you exactly where you stand.

Your Long Island homeownership journey starts with education, continues with strategy, and succeeds with perseverance.

Related Articles:

- The Complete Guide to Long Island Down Payment Assistance Programs

- Nassau vs. Suffolk: Where First-Time Buyers Can Actually Afford

- Long Island Property Tax Guide: What Every Homeowner Should Know

- FHA vs. Conventional: Which Mortgage is Right for Long Island Buyers?

- How to Win a Bidding War Without Overpaying on Long Island

Resources:

- Long Island Housing Partnership (LIHP): (631) 435-4710, www.lihp.org

- Community Development Long Island (CDLI): www.cdli.org

- SONYMA: 1-800-382-4663, hcr.ny.gov/sonyma

- HUD Housing Counseling: (800) 569-4287

- Federal Home Loan Bank of NY: www.fhlbny.com