There was a moment — somewhere between 2020 and 2023 — when buying a home on Long Island felt less like a real estate transaction and more like an episode of Supermarket Sweep. Open house lines stretched around corners. Buyers waived inspections the way you’d wave off reading a terms-and-conditions agreement. Offers arrived 20%, 30%, even 40% over asking. In Nassau County alone, the median home price surged from $525,000 in early 2020 to over $820,000 by early 2025 — a staggering 56% run-up in just five years.

That era is now firmly in the rearview mirror. What’s replacing it isn’t a crash. It isn’t a buyer’s market windfall. It’s something more nuanced — and arguably more significant for anyone navigating Long Island real estate right now. Industry analysts are calling it The Great Normalization: a measured, structural reset after one of the most anomalous housing periods in modern American history. Understanding what’s driving it, what the data says, and what it means for buyers and sellers in Nassau and Suffolk counties isn’t just useful — it’s essential.

How We Got Here: The Five-Year Frenzy in Context

To understand where the Long Island market is going, it helps to appreciate just how extraordinary the last five years were — and why real estate historians will study this period for decades.

The catalyst was March 2020. When the pandemic shuttered New York City, something remarkable happened: affluent Manhattan and Brooklyn residents, suddenly untethered from offices and desperate for outdoor space, flooded Long Island’s residential market. Simultaneously, the Federal Reserve slashed the benchmark rate to near zero. The average 30-year mortgage fell to 3.29% in March 2020 — the lowest Freddie Mac had recorded since it began tracking rates in 1971.

The combination was explosive. In Q4 2020, Long Island recorded 9,942 home sales — up sharply from 7,611 in the same quarter of 2019. (Source: The Real Deal / Sharestates, February 2021) By the end of 2021, the median Long Island home price had risen 18.1% in a single year — the highest annual appreciation in 45 years. (Source: Team Rita Market Report, 2022) Suffolk County’s median climbed from $402,444 in February 2020 to $475,000 by February 2021. Nassau jumped $75,000 in the same period. (Source: OneKey MLS via ABC7 Eyewitness News, March 2021)

Nationally, more than 6 million homes sold in 2021 despite skyrocketing prices. Locally, the situation became extreme. By 2022, inventory had hit a four-decade low — fewer than 300,000 homes listed across the entire country. On Long Island, Jonathan Miller — the authoritative voice behind the Elliman Report — noted that only about 3,200 Long Island homes were on the market in the last quarter of 2024, the lowest figure since 2003. That’s down from over 17,000 homes available a decade earlier. (Source: NBC New York, January 2025)

“What you’re seeing is record prices, and supply or choices for consumers [being] very limited.” — Jonathan Miller, author of the Elliman Report

The timeline of the frenzy era:

- Spring 2020 — Pandemic triggers the NYC exodus. Record-low mortgage rates ignite purchasing power never seen before.

- 2021 — National inventory hits all-time lows. Over half of all U.S. homes sell above list price. LI median prices rise 18.1% in one year.

- Early 2022 — The Fed begins the most aggressive rate-hiking cycle in 40 years. 30-year mortgages climb from 3% to over 7% in under 12 months. Buyers hesitate — but sellers hesitate more, creating the infamous “lock-in effect.”

- 2023–2024 — Nassau and Suffolk inventory hovers at 1.5–2 months of supply — less than a third of a balanced market. Prices hold. The market freezes in an uncomfortable stalemate.

- Late 2024–2025 — Life events override financial inertia. New listings rise. The Great Normalization begins.

The Numbers Behind the Normalization

What does the data actually say about where we are right now? The picture is more complex — and more stable — than most headlines suggest.

As of early 2026, Long Island remains a seller’s market by technical definition. A balanced market requires 5–6 months of housing supply. Nassau County is sitting at roughly 2.5 to 2.6 months; Suffolk at 2.7 to 2.8 months — still less than half of what economists consider equilibrium. If not a single new listing entered the market today, Nassau’s entire inventory would sell within approximately 75 days. (Source: EXIT Realty Premier, November 2025)

But the psychology has shifted. And in real estate, psychology often moves markets before the data catches up.

| Metric | Nassau County | Suffolk County | Trend |

|---|---|---|---|

| Median Single-Family Price (March 2025) | $820,000 | $655,000 | ↑ YOY |

| Year-Over-Year Price Change | +12.3% | +7.4% | ↑ Growth |

| Months of Inventory | 2.5–2.6 mo. | 2.7–2.8 mo. | ↔ Slight expansion |

| Sold-to-List Price Ratio | ~101% | ~100.6% | ↔ Cooling from 2021 peaks |

| Avg. Days on Market (Nassau) | 63 days | — | ↔ Steady |

| New Listings YOY (Q1 2025) | +3.8% | +11.7% | ↑ Inventory returning |

| Inventory Change YOY | –9.0% active | +11.7% new listings | ↔ Diverging counties |

Sources: OneKey MLS; EXIT Realty Premier Monthly Reports; Jones Hollow Realty Group Q1 2025 Update

Nassau’s 12.3% year-over-year gain is hardly a sign of collapse — prices are still rising. But the sold-to-list ratio has come down from the delirious peaks of 2021–2022, when homes routinely traded 20–40% above asking. Today’s 101% sold-to-list means that well-priced homes still attract competition, but the era of blind overbidding is largely over.

The two counties are diverging meaningfully. Nassau is actually losing active inventory (down 9% year-over-year), keeping upward pressure on prices. Suffolk is seeing new listing growth of 11.7%, giving buyers more breathing room — and likely moderating Suffolk’s price trajectory relative to Nassau going forward.

📺 Recommended video: “What’s Really Happening in the U.S. Housing Market Right Now” — Wall Street Journal. Excellent national normalization explainer that mirrors Long Island patterns. Search YouTube: “WSJ housing market normalization 2025.”

Four Forces Driving the Shift

The normalization isn’t random, and it isn’t born of weakness. Four distinct structural forces are reshaping Long Island real estate simultaneously.

1. The Lock-In Effect Is Finally Cracking

The single biggest factor suppressing Long Island inventory since 2022 has been the “golden handcuffs” phenomenon. Homeowners who locked in mortgages at 2.5%–3.5% between 2020 and 2022 have had almost zero financial incentive to sell and trade into today’s 6.5%+ mortgage environment. As Jonathan Miller explained via NBC New York: “Consumers locked into a mortgage rate of three or four percent from four or five years ago aren’t selling.”

But life events don’t wait for mortgage rates to cooperate. Divorce, death in the family, job relocations, growing households, aging parents — these accumulated to a tipping point by late 2024, and long-delayed listings are finally entering the market.

2. Rates Have Stabilized — Without Dropping

Buyers held out for the Fed to deliver relief into the 4s. Instead, 30-year fixed rates have hovered in the mid-to-upper 6% range — high enough to constrain purchasing power, but stable enough that buyers are no longer paralyzed. The result: the buyer pool has self-selected toward serious, financially qualified purchasers. The casual “let’s see what’s out there” buyer of 2021 has largely exited, replaced by someone moving with genuine purpose.

3. The Psychology of Options Has Returned

In behavioral economics, there’s a well-documented phenomenon: the mere presence of alternatives fundamentally changes decision-making. During 2021–2022, buyers with zero alternatives behaved desperately — waiving inspections, paying $142,000 over asking price on individual documented Long Island deals (Source: Ronald S. Cook, LLM, March 2025), even offering to let sellers live rent-free post-closing.

Today, with modestly more inventory, buyers have options. They’re requesting inspections again. They’re taking more time. They’re negotiating. The shift from FOMO (Fear of Missing Out) to FOBO (Fear of a Better Option) is one of the most consequential behavioral changes in the normalization story. As one market analyst put it plainly: Buyers in 2021 had FOMO. Buyers in 2025 have options. That’s a major shift.

4. Investors Are Getting Selective

During the frenzy, investors scooped up nearly every available property, particularly fixer-uppers. That appetite has cooled considerably. With higher carrying costs and compressed exit margins, investors are now far more discriminating. Properties that would have been absorbed instantly in 2021 now sit longer when they require meaningful renovation — creating opportunities for patient, well-prepared end buyers.

“Inventory isn’t rising evenly across Long Island. Older homes needing updates are the segment slowing down.” — Matt Klages, Long Island Real Estate Connection, 2025

📚 Further reading: “Thinking, Fast and Slow” by Daniel Kahneman (Farrar, Straus & Giroux, 2011) — the behavioral economics classic that explains frenzy-era buyer behavior and the current course correction. Also see research by Dr. Selma Hepp, Chief Economist at CoreLogic, on the mortgage rate lock-in effect.

Nassau vs. Suffolk: Two Markets, One Island

One of the most important — and underreported — stories in Long Island real estate right now is that Nassau and Suffolk are diverging in ways that matter enormously to buyers and sellers. Treating them as a monolithic market is a strategic mistake.

Nassau County: Still Tight, Still Competitive, Still Expensive

Nassau’s inventory is actually falling year-over-year, down 9% as of March 2025. This ongoing supply constraint has kept Nassau’s price trajectory steep. At a median of $820,000 for single-family homes — with the upper tier (5+ bedrooms) hitting $1.1 million — Nassau remains one of the most expensive suburban markets in the United States. (Source: EXIT Realty Premier, April 2025)

The bifurcation within Nassau is also telling. The median list price hit $989,000 in November 2025, but the median sold price was $840,000 — a gap of nearly $150,000. (Source: EXIT Realty Premier, December 2025) Sellers testing aggressive valuations are being humbled by the market. Sellers pricing to reality are still winning.

Suffolk County: More Inventory, More Opportunity, More Negotiating Power

Suffolk presents a markedly different picture. New listings surged 11.7% year-over-year, and with 2,971 active listings (versus Nassau’s 2,106), buyers have considerably more breathing room. The median price of $655,000 represents a 7.4% annual gain — respectable, but notably less aggressive than Nassau’s trajectory. (Source: EXIT Realty Premier, March 2025)

For first-time buyers or move-up buyers priced out of Nassau, Suffolk increasingly represents the strategic play — particularly in communities like Huntington, Smithtown, Commack, and the North Fork.

🏠 For Buyers — What to Do Right Now:

- Get fully underwritten, not just pre-qualified. In competitive situations, this is as close to cash as a financed buyer gets.

- Target the stigma gap. Homes listed 45+ days without selling are ripe for negotiation. A small concession or renovation budget often unlocks great deals that frenzy-era buyers never saw.

- Consider the Nassau-Suffolk border communities — you can often get 20–30% more home for your dollar with comparable commute access.

💰 For Sellers — What to Do Right Now:

- Price at market, not above it. The 101% sold-to-list ratio only applies to correctly priced homes. Overpriced homes are experiencing price reductions and market-time stigma that erodes final value.

- Invest in presentation. Move-in ready homes command 10–15% premiums over comparable homes needing work.

- Understand the $150,000 gap between Nassau’s median list and sold price. That gap is the cost of overconfidence.

The Smarter Buyer Has Arrived — And Sellers Need to Know It

If there’s one behavioral shift that defines the normalization era above all others, it’s this: the buyer of 2025 is a fundamentally different creature than the buyer of 2021.

The 2021 buyer was often panic-driven, emotionally exhausted from losing multiple offers, and willing to do almost anything to secure a home. Waived inspections. Escalation clauses with no ceiling. Letters to sellers promising to love their house. Buyers paying sellers’ moving costs, closing costs, and in some documented Long Island cases, offering to let sellers live rent-free for months after closing. These weren’t outliers — they were standard features of the frenzy market, reported by ABC7 Eyewitness News and documented in OneKey MLS data.

That buyer has been replaced by someone more deliberate, more analytical, and more sophisticated. Today’s active buyer has typically been searching for 12–24 months. They’ve attended dozens of open houses. They understand absorption rates and Days on Market. They’re requesting inspections. They’re asking about oil tank certification, cesspool age, flood zone mapping, and Certificate of Occupancy compliance. And increasingly, they’re walking away from deals that don’t pencil out.

As real estate economist Lawrence Yun of the National Association of Realtors noted in his 2024 annual outlook, markets transitioning from frenzy to normalization typically see a 6–12 month lag in seller psychology — meaning sellers expect 2021-era results for 2025-era market conditions, and are consistently disappointed. The growing gap between Nassau’s median list price ($989,000) and median sold price ($840,000) is the statistical fingerprint of seller overconfidence colliding with buyer discipline.

Today’s buyers are also far more attuned to total cost of ownership. Long Island property taxes — which rank among the highest in the United States, with Nassau routinely among the top 3 highest-tax counties nationally — are now central to purchase decisions. Homeowner’s insurance costs, elevated by climate-risk reappraisals particularly for South Shore waterfront communities, are part of every serious buyer’s underwriting today. During the frenzy, these costs were afterthoughts. Today, they’re dealbreakers.

“There are a lot of new listings, and sellers are sensitive to pricing. With our guidance, they are thoughtful and realistic about what number they can achieve.” — Christina Teagle, Daniel Gale Sotheby’s International Realty, Q1 2025

📺 Recommended video: “Housing Market Correction vs. Crash: What’s the Difference?” — CNBC Make It. Clear breakdown of what a correction looks like vs. an actual crash. Search YouTube: “CNBC housing market correction 2025.”

📚 Essential reading: “Irrational Exuberance” (3rd ed.) by Nobel laureate Robert Shiller (Princeton University Press) — the foundational academic text on housing market psychology, bubble formation, and mean reversion cycles. Shiller’s framework explains both why the 2020–2022 frenzy happened and why normalization is the statistically inevitable outcome.

“Is This a Crash?” — The Honest Answer

Let’s address the elephant in the room directly, because this question is the subtext of virtually every real estate conversation on Long Island right now.

No. This is not a crash. The data makes that unambiguous.

A housing market crash is defined by rapid, sustained price declines driven by forced selling, collapsing demand, or fundamental oversupply. Long Island has none of these conditions. Prices in Nassau County are up 12.3% year-over-year as of March 2025. Suffolk is up 7.4%. The sold-to-list ratio remains above 100%. Inventory is still at less than half of a balanced market level. Foreclosure rates are near historic lows. Equity is substantial: Long Island homeowners who’ve owned for 3+ years have seen values rise roughly 16% over the last 36 months alone. (Source: Educators Realty, December 2025)

The more historically accurate analogy is the mid-1990s transition and the 2012–2014 recovery period, when Long Island’s market moved out of distortion into healthier, more sustainable pricing dynamics. Both transitions felt jarring to sellers conditioned to frenzy conditions. Neither produced a crash. Both ultimately served the long-term health of the market and the buyers who entered during normalization.

Key markers that distinguish a normalization from a crash:

- Prices are still rising (just more slowly) ✓

- Inventory is rising from historic lows, not from abundance ✓

- Sold-to-list ratios remain above 100% ✓

- Foreclosure rates are near record lows ✓

- Buyer demand is driven by genuine need, not speculation ✓

- Lending standards are strict, not loose ✓

Long Island’s structural demand drivers haven’t changed. Proximity to New York City — one of the world’s great economic engines — is permanent. The shortage of developable land constrains new construction permanently. Nassau’s population density and transit infrastructure create a permanent floor under demand. Long Island remains one of the strongest, most stable residential real estate markets in the United States. The normalization changes the tactics required to succeed here — not the fundamental investment thesis.

The scenario worth monitoring (not panicking about, but being strategic around): if inventory continues rising into late 2026 while rates remain elevated, the price stabilization we’re seeing could tip into modest price softening, particularly for older, un-updated homes in weaker school districts. This is why strategic timing matters for sellers today — not fear, but thoughtful urgency.

Your 2025–2026 Playbook: Strategies That Work in a Normalized Market

The most dangerous thing you can bring to a normalizing market is a strategy built for a frenzy. Here’s what actually works right now.

FOR SELLERS: The Complete 2025 Strategy

Price aggressively at market, not above it. Review the last 90 days of comparable closed sales with your agent — not list prices, not automated estimates like Zestimate, which EXIT Realty Premier’s data shows is currently lagging actual sold prices by as much as $100,000+ in some Nassau communities. The 101% sold-to-list ratio only applies to correctly priced homes. Overpriced homes are experiencing price reductions and market time stigma that systematically erodes final value.

Invest in turnkey presentation. Move-in ready homes are commanding 10–15% premiums over comparable homes needing work. In the current market, professional staging, fresh paint, high-quality photography, and curb appeal investment pay off in multiples. Buyers doing inspections again means deferred maintenance issues will surface — better to address them proactively than to lose a deal after 60 days on market.

Time your listing strategically. Listing ahead of the spring wave (January–February) means less seller competition for buyer attention. Listing at peak spring (March–May) maximizes buyer traffic. Both strategies work — the right answer depends on your home’s profile and personal timeline.

Be proactively transparent. Have inspection reports, CO certificates, permit histories, and oil tank documentation ready before you list. Today’s smarter buyer will scrutinize everything. Discovering issues pre-listing lets you control the narrative and pricing rather than having them emerge as renegotiation leverage.

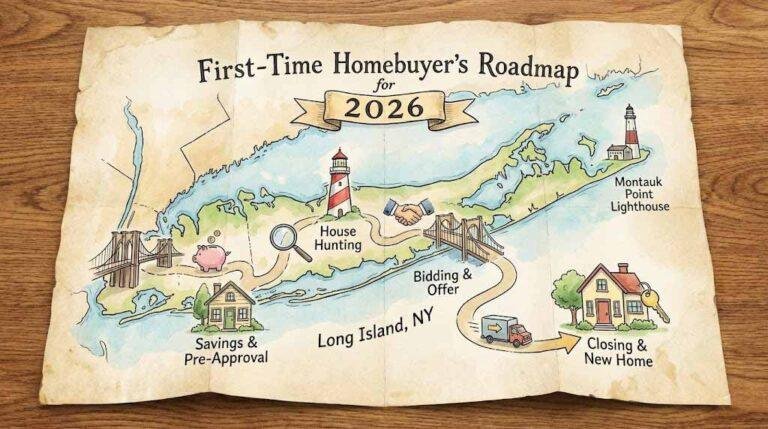

FOR BUYERS: The Complete 2025 Strategy

Get fully underwritten, not just pre-qualified. A fully underwritten pre-approval signals to sellers that you’re essentially as good as a cash buyer — a decisive competitive advantage in a market where good homes still attract multiple offers.

Budget for total cost of ownership. On Long Island, property taxes (among the nation’s highest), homeowner’s insurance (rising due to climate risk reappraisals), and near-term capital expenditures on roof, HVAC, and cesspool can add $15,000–$30,000 annually to your true cost of ownership beyond your mortgage payment. Model this before you fall in love with a price.

Don’t wait for rate drops that may not come. Rates in the mid-6s may be the new baseline for 12–24 months. The “marry the house, date the rate” strategy — buy now, refinance if rates fall — is financially sound and avoids the risk of buying in a more competitive market later. Several North Fork brokers noted in Q1 2025 that buyers are increasingly motivated by exactly this logic: “Buyers hoping to buy before interest rates go down, so they can refinance while there is less competition.” (Source: Behind the Hedges, May 2025)

Homes listed 45+ days without selling are ripe for negotiation — the market has already spoken about their pricing. A small improvement investment or price concession often unlocks genuine value.

Insist on inspections. This is non-negotiable again. The era of waiving inspections is over except in the most extreme competitive situations on turnkey properties.

What Comes Next: The Road Into 2026 and Beyond

The industry’s consensus is crystallizing around what EXIT Realty Premier called “a ‘Great Normalization’ rather than a dramatic recovery or correction” — a period defined by necessity-driven activity, life-event-triggered listings, and the continued maturation of buyer sophistication. (Source: EXIT Realty Premier, December 2025)

The most likely scenario for 2026: modest but continued price appreciation in the 4–7% range, gradually improving inventory (particularly in Suffolk), sustained divergence between turnkey homes (competitive) and dated inventory (facing pricing pressure), and a market where strategy, preparation, and professional guidance separate exceptional outcomes from average ones.

The stock market volatility characterizing early 2026 is actually creating a tailwind for Long Island real estate. Multiple Q1 2025 brokers observed: “The current stock market volatility has helped real estate sales — it’s a safe place to park money, and it’s a tangible asset you can also live in.” Real estate’s dual nature as both shelter and store of value becomes particularly compelling during periods of financial market uncertainty. Long Island, with its proximity to Manhattan, scarcity of developable land, and deep quality-of-life appeal, sits at the center of that value proposition.

What won’t return — at least not anytime soon — is the anything-goes mentality of 2021. That was an extraordinary moment born of extraordinary, converging circumstances: a once-in-a-century pandemic, the fastest monetary policy swing in modern history, and the largest demographic wave of millennial homebuyers in history all crashing into the market simultaneously. The normalization isn’t a failure of the market. It’s the market doing exactly what healthy markets do: finding equilibrium after an extreme.

For buyers, that equilibrium is an invitation. For sellers, it’s a strategic imperative. For everyone, it’s a reminder that Long Island real estate — with its deep roots, tight geography, world-class school districts, and irreplaceable proximity to the world’s greatest city — rewards those who engage with the market as it actually is, not as they wish it were.

“The real estate market is changing — not crashing. Inventory is rising — not exploding. Prices are stabilizing — not collapsing. But these shifts matter, because psychology drives real estate, and when buyers gain options, sellers must gain strategy.” — Matt Klages, 2025 Long Island Housing Inventory Surge Report

Ready to navigate the normalized market with a clear strategy? Whether you’re buying, selling, or simply trying to understand where things are headed, Heritage Diner Real Estate is here to give you straight answers.

Sources & Citations

- EXIT Realty Premier, Long Island Housing Market Overview: March 2025 (April 2025)

- EXIT Realty Premier, Long Island Housing Market Report: November 2025 & The Road Ahead (December 2025)

- Matt Klages, 2025 Long Island Housing Inventory Surge: What Homeowners Need to Know (November 2025)

- Jones Hollow Realty Group, Q1 2025 Long Island Real Estate Market Update (April 2025)

- Norada Real Estate, Long Island Housing Market: Prices, Trends, Forecast 2025–2026

- NBC New York, Long Island Real Estate: What’s Causing House Prices to Skyrocket? (January 2025) — featuring Jonathan Miller, Elliman Report

- ABC7 Eyewitness News, Home Prices on Long Island Skyrocket Due to Surge in Demand (March 2021)

- Sharestates, How the Pandemic Has Affected Long Island Real Estate (February 2021)

- Team Rita, 2022 Long Island Housing Market Starts with a Surge (February 2022), citing Freddie Mac rate data

- Behind the Hedges, The Long Island Real Estate Market Status: Q1 2025 Agent Roundtable (May 2025)

- Educators Realty, Nassau & Suffolk County Market Activity Reports (December 2025), sourced from RPR & OneKey MLS

- Ronald S. Cook, LLM, Navigating Long Island’s Competitive Real Estate Market (March 2025)

- Fox 5 New York, Long Island Home Prices Surge: Here Are 3 Factors That Could Lower Them (July 2024)

- National Association of Realtors / Lawrence Yun, 2024 Annual Real Estate Outlook

- Robert J. Shiller, Irrational Exuberance, 3rd ed. (Princeton University Press, 2015)

- Daniel Kahneman, Thinking, Fast and Slow (Farrar, Straus and Giroux, 2011)

- Dr. Selma Hepp, CoreLogic, Mortgage Rate Lock-In Effect Research (2023–2025)

- Freddie Mac, Primary Mortgage Market Survey — historical 30-year rate data

Content is for informational purposes. Consult a licensed real estate professional before making any buying or selling decisions.