When people think “tech hub,” Silicon Valley comes to mind first. Maybe Seattle, Boston, or Austin. But ask anyone in the industry where the real action is happening in 2026, and they’ll tell you: New York City.

Not the New York of finance and Madison Avenue advertising (though those industries are still here). We’re talking about the New York that’s home to over 25,000 tech startups valued at $189 billion, the city that’s produced 146 unicorns, the place where AI companies raised $6 billion in a single year.

New York City is now the world’s second-largest tech ecosystem, trailing only Silicon Valley — and gaining ground fast. In some metrics, it’s already ahead. Manhattan recently overtook San Francisco in the number of early-stage startups, with 543 companies raising seed or Series A funding between March 2022 and March 2023.

But how did this happen? How did the city famous for Wall Street and Broadway become a genuine rival to Silicon Valley? And more importantly for Long Island residents: what does this transformation mean for opportunities, careers, and economic growth just 30 miles east of Manhattan?

Let’s tell the story of NYC’s unlikely tech rise — and why Long Island needs to pay attention.

The Origin Story: Silicon Alley’s First Act (And Failure)

This isn’t New York’s first attempt at tech dominance. In the late 1990s, lower Manhattan birthed “Silicon Alley” — a hopeful name mimicking Silicon Valley. Startups proliferated in Flatiron, SoHo, and Tribeca. Investment poured in. The future looked bright.

Then the dot-com bubble burst in 2000. Silicon Alley collapsed spectacularly. Companies that had raised millions vanished overnight. The term “Silicon Alley” became a punchline. By 2002, conventional wisdom said New York couldn’t compete with San Francisco in tech — the city was too expensive, too focused on finance, lacking the engineering culture that made the Valley special.

What changed?

The Four Pillars: Why NYC Finally Made It Work

1. The Secret Weapon: Diversity (Both Kinds)

Silicon Valley has concentrated tech expertise — everyone codes, everyone networks, everyone lives and breathes startups. This creates innovation but also groupthink.

New York took the opposite approach. The city’s economy was already the world’s most diverse: finance, fashion, media, advertising, real estate, healthcare, legal, arts, food service, retail. Tech companies in NYC naturally began serving these industries, creating “vertical” startups rather than horizontal platforms.

This diversity proved advantageous. A fintech startup in New York could walk down the street and meet with actual bankers. A health-tech company could partner with Mount Sinai or NYU Langone. An ad-tech firm could pitch agencies in Midtown. The proximity to customers that tech companies in Silicon Valley had to replicate artificially was built into New York’s DNA.

The demographic diversity mattered too. New York’s tech workforce represents over 200 languages and every nationality. At Cornell Tech, 32% of companies are founded by women — far above the national average. The city’s immigrant population (47% of tech workers are foreign-born) brings global perspectives that homogeneous tech hubs lack.

As one venture capitalist told TechCrunch in 2025: “Silicon Valley optimizes for technical excellence. New York optimizes for market fit. We’re not building technology looking for problems — we’re solving real problems with technology. That’s the difference.”

2. The Educational Transformation: Cornell Tech and the Academic Boom

In 2011, New York City made a audacious bet. Mayor Michael Bloomberg challenged universities to compete for city land to build an applied sciences campus. Cornell University and Technion-Israel Institute of Technology won, proposing a $2 billion graduate school focused on entrepreneurship and commercializing research.

Cornell Tech opened on Roosevelt Island in 2017. By 2026, it’s become the engine of NYC’s tech transformation. The school doesn’t just educate — it incubates. Every student completes a “Studio” course building an actual startup with industry partners. The campus hosts accelerators, research labs, and connects directly to the broader NYC tech ecosystem.

But Cornell Tech isn’t alone. NYU has 21 accredited engineering schools. Columbia’s engineering programs rank among the world’s best. CUNY, the nation’s largest urban public university system, churns out thousands of graduates annually in computer science and related fields.

The numbers tell the story: NYC has over 120 colleges and universities producing a steady stream of tech talent. Between 2010 and 2023, tech job growth in NYC was 7 times faster than overall job growth.

Contrast this with Silicon Valley, which increasingly struggles with talent shortages and relies heavily on H-1B visa holders. New York produces enough local talent to sustain growth while still attracting global stars.

3. The Infrastructure Build-Out: From Dark Fiber to Smart Buildings

New York invested heavily in digital infrastructure. The city’s dark fiber network — unused fiber optic cables that companies can “light” with their own equipment — expanded dramatically. By 2026, NYC has one of the world’s densest fiber networks, with 418 track-miles in subway tunnels alone and 20+ river crossings.

This infrastructure isn’t just about speed — it’s about control and security. Financial firms need microsecond-level latency for high-frequency trading. Healthcare systems need HIPAA-compliant private networks. Media companies need massive bandwidth for 4K video production. New York’s infrastructure delivers all of this.

The city also became a leader in smart city technology. New York was ranked the #1 smart city in North America in 2023, leveraging sensors, AI, and data analytics to manage services for 8+ million residents. This created a natural testing ground for tech companies developing urban solutions.

For tech startups, this infrastructure meant they could build and scale in New York without the reliability and connectivity concerns that plagued other cities.

4. The Money Arrived: VC Funding Explodes

For years, raising venture capital in New York meant eventually moving to Silicon Valley for serious funding rounds. That’s changed completely.

In 2015, 15% of U.S. venture deals happened in NYC. By 2023, it was over 20% — and over $21 billion flowed into NYC fintech alone in 2022. Total venture investment in NYC’s tech ecosystem exceeded $40 billion annually by 2024.

Major VC firms opened New York offices. Sequoia, Andreessen Horowitz, Kleiner Perkins — all the Valley names established substantial NYC presences. Homegrown firms like Union Square Ventures, Lerer Hippeau, and FirstMark Capital became just as influential.

More importantly, the type of capital changed. New York’s proximity to Wall Street meant access to late-stage growth equity, corporate venture capital, and eventually, the public markets. Companies could scale from seed to IPO without leaving the tri-state area.

The Sectors That Put NYC on Top

New York didn’t try to copy Silicon Valley’s focus on consumer social apps and hardware. Instead, it doubled down on what it knew best:

Fintech: The Obvious Winner

With Wall Street in its backyard, NYC’s fintech dominance was inevitable. But the scale is staggering. The city is home to 375 fintech startups that raised over $21 billion in 2022. Stripe, Block (formerly Square), and Robinhood all have massive NYC presences. Newer players like Brex, Ramp, and Plaid maintain significant operations in the city.

Fintech in NYC isn’t just payments and lending. It’s RegTech (regulatory compliance software), WealthTech (robo-advisors and investment platforms), InsurTech (insurance digitization), and Crypto (blockchain and digital assets). Every sub-sector thrives because NYC offers direct access to financial institutions, regulators, and customers.

AI and Machine Learning: The Fastest Growing Sector

NYC AI companies raised $6 billion in 2022, making it a global AI capital. The ecosystem spans from fundamental research (NYU’s AI labs, DeepMind’s NYC office, Meta’s FAIR research team) to applied AI across industries.

What makes NYC’s AI scene unique is its focus on practical applications. While Silicon Valley chases artificial general intelligence, New York builds AI for medical diagnostics (Tempus), fraud detection (Sift), personalized marketing (Persado), and legal research (Casetext).

The city’s AI workforce is substantial too — 92% of NYC executives plan to hire AI talent in the next three years, and 89% are confident they can find those skills locally. By 2038, AI adoption could generate $320 billion in additional economic value for New York State.

AdTech and Media: Leveraging Traditional Strengths

New York has always been the center of American media and advertising. When digital disrupted these industries, the city’s tech scene was ready. Companies like The Trade Desk, Taboola, and Integral Ad Science built massive businesses in digital advertising.

Media companies themselves became tech companies. The New York Times employs hundreds of developers and product managers. Bloomberg is as much a tech company as a financial information provider. Spotify maintains major engineering teams in NYC.

HealthTech and BioTech: The Pandemic Accelerant

COVID-19 turbocharged NYC’s health tech sector. Companies like Zocdoc (doctor bookings), Oscar Health (insurance), and One Medical (primary care) were already growing, but the pandemic made digital health essential.

NYC’s concentration of world-class hospitals and medical schools (Mount Sinai, NYU Langone, Columbia Medical Center, Weill Cornell) provides unmatched research and testing resources. BioTech firms conducting clinical trials can recruit from the nation’s most diverse patient population.

By 2026, health tech represents one of NYC’s fastest-growing sectors, with investments continuing to accelerate.

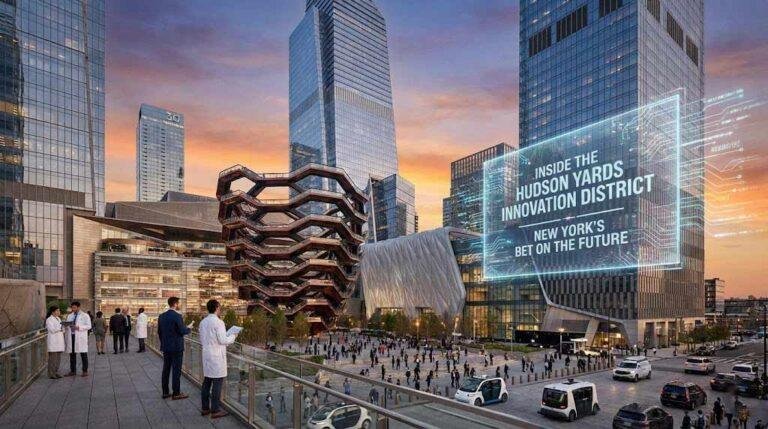

The Geography: From Manhattan to Brooklyn to Queens

Silicon Valley remains geographically concentrated. Nearly everything happens in San Francisco, Palo Alto, and Mountain View.

New York’s tech scene sprawls across all five boroughs, each with distinct characteristics:

Manhattan remains the center, but even here the concentration has shifted. What started in lower Manhattan’s Flatiron District has spread to Hudson Yards, Chelsea, Midtown, and the Financial District. Google’s NYC headquarters at 111 Eighth Avenue houses over 14,000 employees — making it Google’s second-largest office globally.

Brooklyn experienced the most dramatic transformation. DUMBO (Down Under the Manhattan Bridge Overpass) became Brooklyn’s answer to Silicon Valley, housing hundreds of startups and scale-ups. Williamsburg and Bushwick followed. Between 2008 and 2023, Brooklyn’s startup ecosystem grew 356% — the fastest growth of any major tech hub.

Queens is the frontier. Long Island City attracted Amazon (briefly) and continues to draw tech companies looking for cheaper space and diverse talent pools. Astoria and Jackson Heights are quietly building tech communities.

The Bronx lags but is catching up, particularly in health tech leveraging its hospitals and medical research institutions.

Staten Island remains mostly outside the tech boom, though remote work is changing this somewhat.

The Brooklyn Effect: Why It Matters

Brooklyn deserves special attention because its tech growth patterns closely mirror what could happen on Long Island.

In 2008, Brooklyn was not a tech destination. Rents were lower than Manhattan but still high. The borough lacked the density of infrastructure and talent pools. People questioned whether tech companies would locate there.

Fast forward to 2026: Brooklyn tech is a $30+ billion ecosystem. Startups chose Brooklyn deliberately — lower overhead, access to diverse talent, proximity to Manhattan without Manhattan costs, and neighborhoods with actual character rather than sterile office parks.

Brooklyn’s tech growth created spillover effects throughout the borough: better restaurants, improved public transit, renovated buildings, increased property values, more cultural venues, and a virtuous cycle of growth.

This pattern — lower-cost areas near major tech hubs becoming tech destinations themselves — is precisely what Long Island has the potential to replicate.

What This Means for Long Island: Proximity Is Power

So why should anyone on Long Island care about NYC’s tech boom? Because geography still matters.

Long Island sits 30 miles from Manhattan. That’s closer than San Jose to San Francisco. Closer than Austin suburbs to downtown. Closer than most of Seattle’s tech workforce to Amazon’s headquarters.

In an era of remote and hybrid work, this proximity is gold. Tech workers can live on Long Island — with better schools, larger homes, access to beaches and nature — while still participating in the NYC tech ecosystem.

The evidence is already emerging:

Remote Workers Are Moving Out: The pandemic proved that tech workers don’t need to live in Manhattan to work for Manhattan companies. Many moved to Long Island for more space and lower costs while maintaining their NYC salaries. That trend hasn’t reversed in 2026.

Startups Are Looking East: NYC real estate remains expensive. Office space in Manhattan runs $60-90 per square foot annually. Long Island offers comparable space for $25-40. For cash-constrained startups, this matters.

Transit Improvements Help: The LIRR’s East Side Access to Grand Central dramatically reduced commute times from Long Island to Manhattan. What was once a painful 60-90 minute commute is now 30-45 minutes for many routes. This makes Long Island viable for people who still work in-office occasionally.

Talent Pool Expands: Stony Brook University, Hofstra, Adelphi, and other Long Island institutions produce thousands of STEM graduates annually. Many leave the island for NYC or elsewhere because “there’s no tech jobs on Long Island.” As that changes, these graduates stay local.

Cost of Living Arbitrage: A junior developer earning $120,000 in NYC can’t afford much in Brooklyn or Manhattan. That same person on Long Island can buy a house, raise a family, and save money. For companies competing to hire talent, promoting “NYC salary, Long Island cost of living” becomes attractive.

The First Movers: Tech Companies Already on Long Island

Long Island’s tech ecosystem remains small compared to NYC, but it’s growing. Companies are starting to notice.

CA Technologies (now part of Broadcom) has long maintained a major presence in Islandia. While not a startup, it employs thousands and anchors Long Island’s tech employment.

Accelerate Long Island is an innovation hub in Stony Brook supporting tech startups and entrepreneurs. While modest compared to Brooklyn accelerators, it’s providing infrastructure for early-stage companies.

WeWork and Similar Co-Working Spaces have expanded to Long Island, recognizing demand from remote tech workers and small companies needing professional space.

Several NYC-Based Startups now allow fully remote work, and many employees have moved to Long Island. This diffuses NYC’s tech culture eastward even without physical offices.

The question isn’t whether Long Island will participate in NYC’s tech growth — it’s how quickly and to what extent.

The Challenges: What Could Hold Long Island Back

Let’s be realistic. Long Island faces obstacles to becoming a true tech satellite of NYC:

Transit Dependency: The LIRR is expensive and serves limited routes. Driving into NYC is worse — unpredictable traffic and prohibitive parking. Until transit improves further or work-from-home becomes universal, commuting remains painful.

Perception Problem: Long Island is seen as suburbs, not a tech destination. Convincing companies to open offices here requires overcoming decades of “Manhattan or bust” thinking.

Amenities Gap: NYC offers incredible cultural amenities, restaurants, nightlife, and diversity that Long Island can’t match. For young tech workers prioritizing lifestyle, the city remains more appealing.

Funding Scarcity: Long Island lacks local venture capital. Startups here must still travel to Manhattan for investor meetings. This friction disadvantages local entrepreneurs.

Talent Concentration: While Long Island has universities, it lacks the talent density of NYC. Tech workers cluster around other tech workers — that network effect is hard to bootstrap.

Overcoming these challenges requires deliberate effort from local government, educational institutions, and the private sector. It won’t happen organically.

The Opportunity: What Long Island Could Become

Imagine this scenario:

A software engineer earning $180,000 at a Manhattan AI startup decides to buy a home. In Brooklyn, that budget gets a small condo an hour from the office. On Long Island, it gets a 3-bedroom house with a yard, good schools, and a 45-minute LIRR ride to Grand Central.

She moves to Long Island. Two years later, her company decides to open a satellite office in Nassau County — cheaper rent, access to Long Island talent, and half their NYC employees have moved there anyway. The office opens in a renovated space in Garden City.

Other startups notice. “If Company X can hire great people on Long Island, why are we paying Manhattan rent?” Three more companies open Long Island offices in the next year. Local developers renovate office buildings that have sat empty for a decade. A co-working space opens. A coffee shop with good WiFi becomes an unofficial meeting spot.

Five years later, Long Island has a modest but real tech ecosystem. Not rival to Brooklyn, but comparable to, say, Austin’s suburban tech clusters. Thousands of jobs. Dozens of companies. A reputation as a place where tech happens.

This scenario isn’t fantasy — it’s the Brooklyn playbook, applied 30 miles further east.

The Long Island Advantage: What We Have That Others Don’t

Long Island shouldn’t try to copy Manhattan or Brooklyn. It should leverage unique advantages:

Lifestyle Appeal: Tech workers burned out on city living want space, quiet, and nature. Long Island offers beaches, parks, and suburban amenities without abandoning urban access.

Affordability: Relative to NYC or San Francisco, Long Island remains affordable. Housing costs half as much. This matters for both individuals and companies.

Educational Institutions: Stony Brook is a top-tier research university with strong STEM programs. Hofstra, Adelphi, NYIT, and others produce steady talent flows.

Proximity to NYC: This can’t be overstated. Being 30 miles from the world’s second-largest tech hub is an enormous advantage if leveraged properly.

Underutilized Real Estate: Long Island has office parks, industrial spaces, and commercial buildings that could be converted to tech-friendly environments. These spaces sit empty or underused — ready for revitalization.

Diverse Community: Like NYC, Long Island is incredibly diverse. Over 100 languages are spoken in schools. This diversity is attractive to global tech companies.

The Call to Action: What Needs to Happen

For Long Island to capture its share of NYC’s tech growth, several things must happen:

Transit Improvements: Continue investing in LIRR reliability and frequency. Improve east-west transit connections. Reduce commute times and costs.

Tax and Regulatory Incentives: Offer tax breaks to tech companies opening offices on Long Island. Streamline permitting for office conversions. Compete aggressively for companies considering locations.

Educational Partnerships: Strengthen ties between universities and industry. Create internship programs, sponsored research, and direct hiring pipelines. Keep Long Island graduates on Long Island.

Physical Infrastructure: Build co-working spaces, incubators, and tech-friendly office environments. Convert old office parks into modern collaborative spaces. Improve internet infrastructure.

Community Building: Host tech meetups, conferences, and networking events. Create community around Long Island tech. Make it feel like something is happening, not just a bedroom community for NYC.

Venture Capital Presence: Attract or create local venture funds focused on Long Island and regional startups. Remove friction from the funding process.

These require coordination between county governments, business associations, universities, and private companies. It won’t happen quickly, but it can happen.

The Bottom Line: An Inflection Point

New York City’s transformation from financial capital to tech capital took two decades. It required billions in investment, institutional support, infrastructure development, and a generation of entrepreneurs willing to build outside Silicon Valley.

But it worked. In 2026, NYC rivals San Francisco as the world’s premier tech ecosystem. The city has 146 unicorns, thousands of startups, hundreds of thousands of tech workers, and an innovation engine that generates tens of billions in economic value annually.

Long Island stands at the edge of this ecosystem. Close enough to benefit, far enough to offer distinct advantages. The question is whether Long Island will actively position itself to capture spillover growth, or passively watch opportunity pass by.

The next decade will tell the story. Will Long Island remain a commuter suburb, or will it become a genuine tech satellite — a place where innovation happens, companies grow, and careers thrive?

The answer depends on choices made now. NYC showed that with the right strategy, infrastructure, and commitment, a non-traditional tech hub can compete with Silicon Valley.

Long Island can show that proximity to a major tech hub, combined with lifestyle advantages and lower costs, creates its own compelling value proposition.

The pieces are in place. The opportunity is real. What happens next is up to us.

Related Articles

- Long Island’s Hidden Tech Startups You’ve Never Heard Of

- Why Brooklyn’s Tech Boom Offers a Roadmap for Nassau and Suffolk

- The Best Tech Jobs on Long Island in 2026

- How Stony Brook Is Becoming a Tech Talent Pipeline

Sources

- NYC Comptroller – Spotlight: New York City’s Tech Sector

- NYC EDC – Emerging Tech Industry Report

- Built In NYC – Top Tech Companies in NYC 2026

- Nucamp – NYC’s Thriving Tech Hub: Startups and Success Stories

- StartUs Insights – Top 10 Tech Companies in New York City

- Cornell Tech – Annual Impact Report 2025

Watch: How NYC Became a Tech Powerhouse https://www.youtube.com/watch?v=KhHXh8O5uME